News at IBKR vol 19

News @ IBKR - Volume 19

EXPANDED OFFERING

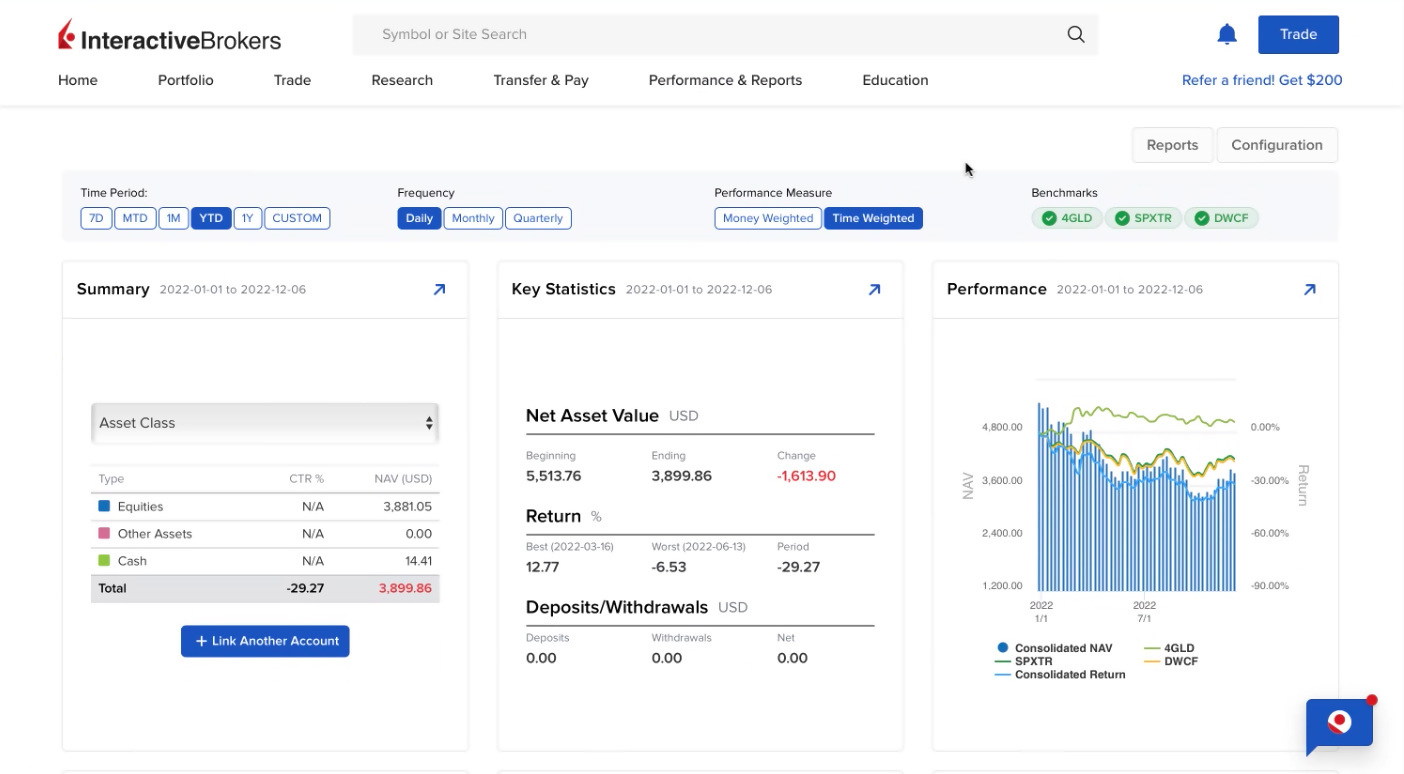

PortfolioAnalyst

NEW TOOLS

Interactive Brokers Launches Overnight Trading Hours for Select US ETFs

| FXI | UNG | RWM | EWJ |

| SPY | TLT | PSQ | IJH |

| EEM | IWM | AGG | VTI |

| GLD | QQQ | DOG | XLF |

| SLV | USO | EWA | XLE |

| DIA | SH | EFA | XLK |

GROWTH

Thomas Peterffy Presents at Goldman Sachs 2022 US Financial Services Conference

New Tools

New Features Added to IBKR Trading Platforms

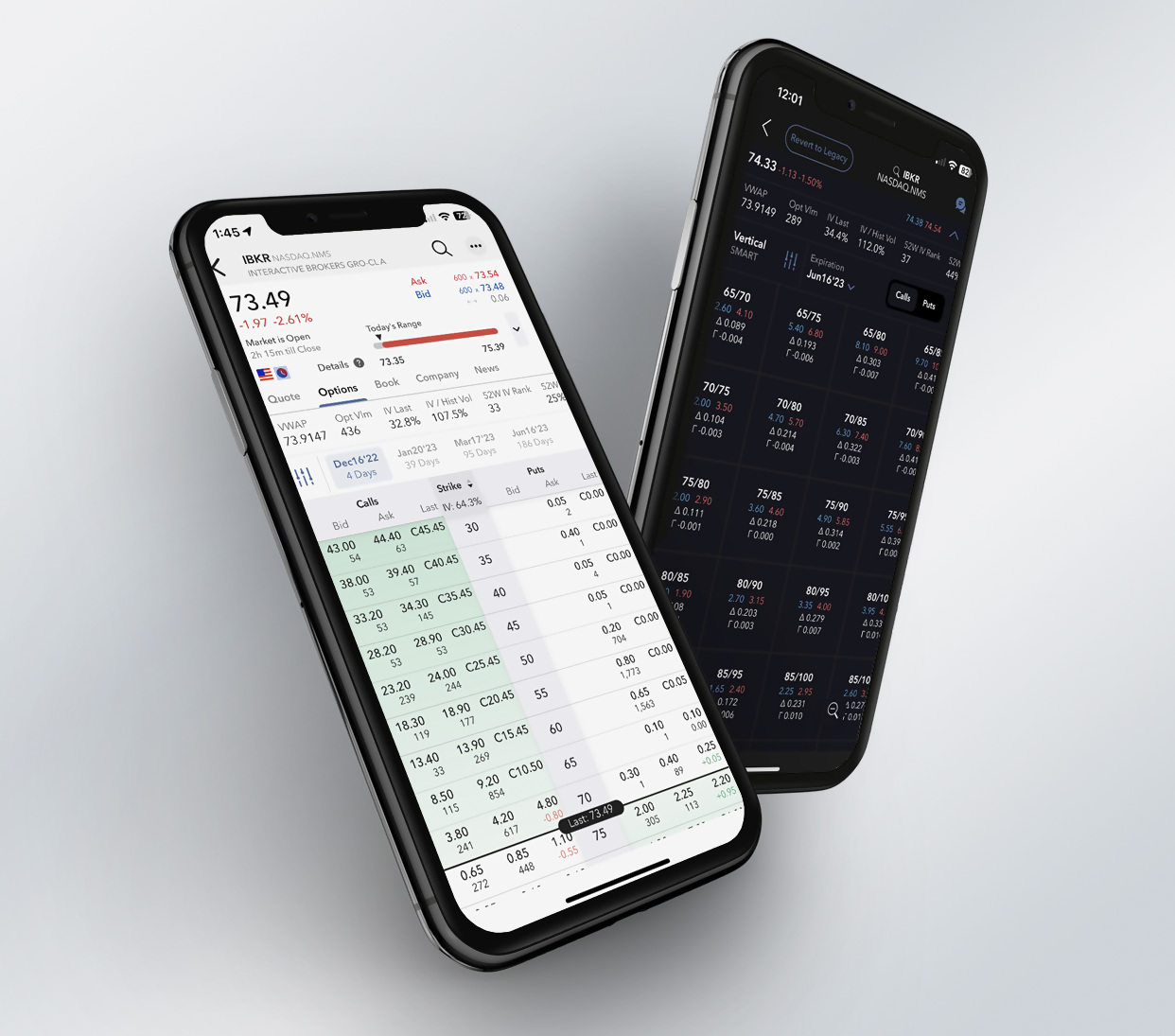

IBKR Mobile

- Improved Quote Details: The redesigned Quote Details has expandable Position and customizable Market Data drawers for easy viewing when open, and a cleaner interface when closed. Options, BookTrader, News and other features are now in tabs for quicker access without scrolling. Currently available for Android and in beta (but coming soon) for iOS.

- Enhanced Option Chains: Powerful Option Chains shows market data in a persistent panel at the top of the chains, so it's always visible, and Last Price is highlighted within the chain. Change the mode to easily create single orders, multi-leg strategies,1 and Calendar, Vertical and Diagonal spreads. See Performance Portfolio, P&L graph, Probability of Profit and more. Tap for Price History or add to Watchlist.

- Advanced Charts: IBKR Mobile has a robust new charting system with sophisticated drawing and annotation tools, trendlines, and unique studies and indicators. To open, tap a chart from Quote Details and rotate your phone to landscape mode.

- Event Contracts: Now, you can monitor Event Contract positions trading in IBKR EventTrader from your mobile portfolio. Additionally, access IBKR EventTrader by tapping an Event Contract in your portfolio.

Portal

- Learn & Earn: Clients can earn commission credits by completing Traders' Academy courses in the Client Portal. Access from the Education > Learn & Earn menu. The feature will only display for eligible users. For more details see the Client Portal Users' Guide.

- Recurring Investments: Clients can now define their investment schedule by selecting a date and picking an investment interval (weekly, monthly, quarterly, etc). Access this feature from your Portfolio, the Trade > Orders & Trades menus, and Quote Details. Find out more in the Recurring Investment Feature article.

- Global Search improvements make it easy to find bonds. Simply type the company name in the search field for results. You can also search by issuer ID.

- Users can quickly access the Corporate Action Manager directly from their Portfolio.

Trader Workstation (TWS)

- We've updated the TWS File menu to let you:

- Switch TWS versions without having to log back in

- Easily log out and back in, and refresh without needing to log in

- Restore settings to the original default

- Advanced Charts (beta): TWS includes a robust new charting system with sophisticated drawing and annotation tools, trendlines, and unique studies and indicators. To open, from the New Window dropdown select Charts and then Advanced Charts.

- Discover: Discover ideas and new markets for potential investments using the Discover tool. Discover is your link to market-defining third-party content selected specifically to help you improve your success as a trader. Discover supports content from Trading Central, a "premium, one-stop shop for investment decision support".

IBKR GlobalTrader and IMPACT

- Now you can monitor Event Contract positions trading in IBKR EventTrader from your mobile portfolio. Additionally, access IBKR EventTrader by tapping an Event Contract in your portfolio.

- IBKR GlobalTrader: Trade select US ETFs around the clock, five days a week. Overnight Trading Hours are from 8:00 pm ET to 3:30 am ET, with the first session beginning on Sunday at 8:00 pm ET and the last session ending on Friday at 3:30 am ET. All trades will be executed on the IBEOS ATS, and any trades executed between 8:00 pm and 12:00 am will carry a trade date of the following trade day.

EXPANDED OFFERING

New Funds and Fund Families Available at the Mutual Funds Marketplace

Global Fund Families

US Fund Families

EXPANDED OFFERING

Find Your Next Opportunity at the Bonds Marketplace

41,400+

21,500+

1,400+

1,024,000+

2,600+

EXPANDED OFFERING

Additional News and Research Providers Available on the IBKR Platform

News

NEW PRODUCTS

New Products Available on the IBKR Platform

Australian Securities Exchange Ltd. (ASX)

Cboe

- CFE will reduce the tick size for Mini Cboe Volatility Index ("VXM") futures.

- C1 will modify the minimum tick size for electronic and verbal bids and offers on single-leg quotes and orders in Cboe Volatility Index (“VIX”) options.

- C1 will require a minimum size on electronic Market-Maker quotes in VIX options.

CME

- GLOBEX and CMECRYPTO were consolidated into a single exchange: CME.

- ECBOT was updated to CBOT.

- COMEX listed metals (previously reflected as NYMEX) were updated to exchange COMEX.

- NYMEX experienced no change.

EUREX

Currencies

- United Arab Emirates Dirham (AED) is available to eligible clients as a base currency.

- The Euro is now available as a base currency for clients of Interactive Brokers Singapore Pte. Ltd.

Smart Investors

Never Stop Learning

Traders' Academy

IBKR Webinars

Traders' Insight

IBKR Podcasts

IBKR Quant

Student Trading Lab