Bonds Margin Requirements

Fixed Income Margin Overview

US Fixed Income Margin Requirements

For residents of the United States trading Fixed Income:

- Rules-based margin

The complete margin requirement details are listed in the sections below.

The following rules apply to both long and short positions for Margin and Portfolio Margin accounts. Bonds must be paid-in-full in a Cash account.

FINRA and the NYSE have imposed rules to limit small investor day trading. Customers that these organizations classify as Pattern Day Traders are subject to special Day Trading Restrictions for US securities.

Government Bonds Margin

| US Treasury Securities | Initial Margin Requirements | Maintenance Margin Requirements |

|---|---|---|

| Less than six months to maturity | 1% * Market Value | Same as Initial Margin |

| Less than one year to maturity | 2% * Market Value | Same as Initial Margin |

| One year but less than three years to maturity | 3% * Market Value | Same as Initial Margin |

| Three years but less than five years to maturity | 4% * Market Value | Same as Initial Margin |

| Five years but less than ten years to maturity | 5% * Market Value | Same as Initial Margin |

| Ten years but less than twenty years to maturity | 7% * Market Value | Same as Initial Margin |

| Twenty years or more to maturity | 9% * Market Value | Same as Initial Margin |

| Zero coupon bonds with five years or more to maturity | 3% * Principal Amount of the Obligation | Same as Initial Margin |

Municipal Bonds

| Initial Margin Requirements | Maintenance Margin Requirements | |

|---|---|---|

| Investment Grade 1 | 1.25 * Maintenance Margin 2 | 25% * Bond Market Value |

| Speculative Grade 1 | 1.25 * Maintenance Margin 2 | 50% * Bond Market Value |

| Junk Grade 1 | 1.25 * Maintenance Margin 2 | 75% * Bond Market Value |

| Defaulted 1 | 100% * Bond Market Value 2 | 100% * Bond Market Value |

Corporate Bonds

The margin for the following types of corporate bonds is determined using a proprietary Value At Risk (VAR) methodology 3:

- Investment Grade

- NYSE-listed Speculative Grade

- NYSE-listed Junk Grade

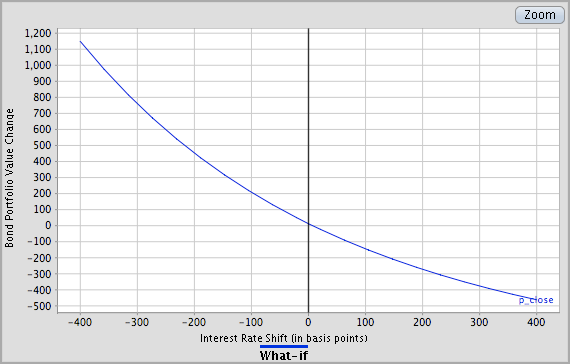

The theoretical price of each bond is calculated over a range of interest rate offsets to the prevailing Treasury yield curve. The result of such a calculation is illustrated in the following figure. As the interest rate offset increases, the bond price decreases. The upward curvature of the line is indicative of the "convexity" of the bond.

The VAR is the worst case loss in the bond price over a specified range of underlying interest rate changes. The scanning ranges are listed in the table below.

| Bond Type | Basis Points |

|---|---|

| Investment Grade (Moody's Aaa to Baa3) | 200 basis points |

| NYSE-Listed Speculative Grade (Moody's Ba1 to B3) | 300 basis points |

| NYSE-Listed Junk Grade (Moody's Caa1 to C) | 400 basis points |

Within the Value At Risk calculation, bonds that contain embedded options (calls or puts) are subjected to stress tests that separately increase and decrease the interest rate period volatilities used to calculate the theoretical price of the bond by 15% of their values. Under each volatility change scenario, another theoretical price curve is calculated over the same range of interest rate offsets to the prevailing Treasury yield curve. The VAR for bonds with embedded options is taken as the worst case loss on the appropriate interest rate scanning range across each of the unchanged, up and down volatility scenarios.

The regulatory minimum margin of 10% of market value applies to investment grade bonds. The regulatory minimum of the larger of 20% of market value and 7% of face value applies to non-investment grade, NYSE-listed bonds.

Non-NYSE-Listed Speculative and Junk Bonds are margined as follows:

| Bond Type | Initial Margin | Maintenance Margin |

|---|---|---|

| Non-NYSE-Listed Speculative Grade | 50% * Bond Market Value | 50% * Bond Market Value |

| Non-NYSE-Listed Junk Grade | 70% * Bond Market Value | 70% * Bond Market Value |

Bonds that have defaulted or that are not rated are not eligible for margin treatment.

Special Margin Bonds

We may reduce the collateral value of securities (reduces marginability) for a variety of reasons, including:

- small market capitalization or small issue size

- low liquidity in the collective primary/secondary exchanges

- involvement in tenders and other corporate action

Changes in marginability are generally considered for a specific security. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including bonds, derivatives, depository receipts, etc.

In addition, please see discussions on special risk management algorithms, for example, large position and position concentration algorithms which may affect the margin rate applied to a given security within an account and may vary between accounts.

Overview of Pattern Day Trading ("PDT") Rules

FINRA and the NYSE have instituted regulations intended to limit the amount of trading that can be done in accounts with small amounts of capital, specifically accounts with less than USD 25,000 Net Liquidation Value.

Pattern

Day Trader

Pattern

Day Trader

Mon

Tues

Wed

Thurs

Fri

Sell XXZ

Sell ZZX

Sell YYZ

Sell YYZ

- Day Trade: any trade pair wherein a position in a security (Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures) is increased ("opened") and thereafter decreased ("closed") within the same trading session.

- Pattern Day Trader: someone who effects 4 or more Day Trades within a 5 business day period. A trader who executes 4 or more day trades in this time is deemed to be exhibiting a ‘pattern’ of day trading and is thereafter subject to the PDT restrictions.

- In order to day trade, the account must have at least USD 25,000 in Net Liquidation Value, where Net Liquidation Value includes cash, stocks, options, and futures P+L.

- We have created algorithms to prevent small accounts from being flagged as day trading accounts. We implement this by prohibiting the 4th opening transaction within 5 days if the account has less than USD 25,000 in equity.

Adjustments to Previous Day's Equity and First Day Trading

The previous day's equity is recorded at the close of the previous day (4:15 PM ET). Previous day's equity must be at least USD 25,000. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required USD 25,000 after 4:15 PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade.

For example, suppose a new customer's deposit of USD 50,000 is received after the close of the trading day. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to USD 50,000 and he is able to trade on the first trading day. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close.

Special Cases

- Accounts that at one time had more than USD 25,000, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below USD 25,000, may find themselves subject to the 90 day trading restriction. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section.

- The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity.

Additional details relating to PDT regulations and our implementation of these rules can be found in the FAQ section.

Day Trading FAQs

FINRA defines a Pattern Day Trader (PDT) as one who effects four or more day trades (same day opening and closing of a given equity security ("stock") or equity option) within a five business day period.

Note that Futures contracts and Futures Options are not included in the SEC Day Trade rule.

A potential pattern day trader error message means that an account has less than the SEC required USD 25,000 minimum Net Liquidation Value AND the number of available day trades (3) has already been used within the last five days.

The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. The system is programmed to protect the accounts with less than USD 25,000 so the account would not "potentially" be flagged as a day trading account.

If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account.

The customer has the following options:

- Deposit funds to bring the account's equity up to the SEC required minimum of USD 25,000

- Request a PDT account reset (if available)

If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions.

The customer will have the same options listed above, however, if at any time the Net Liquidation Value figure goes back above the threshold amount ($25,000), then the account will once again have day trades available.

FINRA has provided brokerage firms the ability to remove the PDT flag from a customer's account once, upon a good faith determination that the customer will no longer engage in pattern day trading. If an account was erroneously flagged, and the customer's intent is not to day trade in his/her account, we have the ability to remove this flag.

FINRA defines a Pattern Day Trader (PDT) as one who effects 4 or more day trades (same day purchase and sale of a given equity security ("stock") or equity option) within a five-day period, and FINRA rules place certain restrictions on those who are deemed to be pattern day traders. If a customer account effects three (3) day trades involving stocks or equity options within any five (5) day period, we will require that such account satisfy the minimum Net Liquidation Value requirement of USD 25,000 before we will accept the next order to purchase or sell a stock or equity option. Once the account has effected a fourth day trade (in such 5 day period), we will deem the account to be a PDT account.

Pattern Day Trading regulations allow a broker to remove the PDT designation, one time only, if the client acknowledges that she/he does not intend to engage in day trading strategies, and requests that the PDT designation be removed. If you wish to have the PDT designation for your account removed, provide us with the following acknowledgement using the online PDT request tool.

- I agree to the following:

- I do not intend to engage in a day trading strategy in my account.

- I hereby request that you the broker no longer designate my account as a "Pattern Day Trading" account under FINRA rules.

- I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account.

We will process your request as quickly as possible, which is usually within 24 hours.

For example, if the window reads (0,0,1,2,3), here is how to interpret this information:

If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. The 2nd number in the parenthesis, 0, means that no day trades are available on Thursday. The 3rd number within the parenthesis, 1, means that on Friday 1-day trade is available. The 4th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. The 5th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available.

Additional US Margin Requirements

For Residents of the United States:

Use the following links to view other margin requirements:

You can change your location setting by clicking here

Further Reading

To learn more about trading on margin, go to our Education Center:

Margin Education CenterDisclosures

- Grades are based on Moody's ratings.

- Investment Grade – AAA to BAA3

- Speculative Grade – BA1 to B3

- Junk Grade – Below B3

- In order to apply other than 100% margin requirement, the bond must satisfy the following:

- not private placement

- not RegS

- not Rule 144A

- original issue size at least $25 million (due to regulatory restrictions)

- At this time, we are unable to provide additional details about the proprietary VAR methodology used to calculate margin for requirements of corporate bonds.

- Interactive Brokers Australia currently offers margin lending to all clients EXCEPT Self- managed Superannuation Fund account holders ("SMSF"). Click here for more information. For clients of Interactive Brokers Australia who are classified as retail, margin loans will be capped at AUD 50,000 (subject to change in IBKR Australia’s sole discretion). Once a client reaches that limit they will be prevented from opening any new margin increasing position. However, how much a client can borrow depends on a number of factors, including: the value of the money or assets contributed by the client as security; which financial products the client chooses to invest in, as we lend different amounts for different products under our risk-based model; and the maintenance margin requirement for the client’s portfolio. Once a client reaches their borrowing limit they will be prevented from opening any new margin increasing position. Closing or margin-reducing trades will be allowed. Refer to this link for information regarding margin accounts offered by IBKR Australia.

- IBKR house margin requirements may be greater than rule-based margin.